How organizations can secure tax-advantaged protection for their most important leaders.

Every year, corporate leaders face an increasing wave of personal, digital, and reputational threats. From online harassment and data breaches to physical risks affecting executives and their families, the modern threat landscape has never been more complex—or more costly.

But here’s what many organizations don’t know:

The IRS already provides a legal, strategic path to protect executives while significantly reducing tax burdens for both the company and the individual.

It’s called IRS Section 132, and when used properly, it’s one of the most powerful tools for executive protection, governance, and financial efficiency.

Strategos International’s Executive Security Risk Assessment (ESRA) and Independent Security Study (ISS) are purpose-built to help organizations unlock these tax-advantaged benefits while strengthening overall security posture.

What Is IRS Section 132—and Why Does It Matter?

IRS Section 132 governs “working condition fringe benefits.” Under this rule, when a company provides security measures due to a “bona fide business-oriented security concern,” those measures are not considered personal perks.

Instead, they become:

- 100% deductible business expenses

- Non-taxable to the executive

- Fully compliant with IRS audit standards

Think of it as a compliance-backed shield that turns necessary security costs into a strategic financial advantage.

How Companies Qualify

To leverage IRS Section 132, organizations must:

-

Prove a legitimate business-related security concern (e.g., visibility, threat history).

- Conduct a qualified Executive Security Risk Assessment.

- Complete an Independent Security Study validating the security need.

- Implement proportionate security measures consistent with the assessed risk.

- Maintain ongoing documentation for IRS compliance.

Strategos International’s methodology aligns precisely with these requirements, producing IRS-defensible documentation and a clear operational roadmap.

The Financial Impact: Real Numbers, Real Savings

IRS Section 132 isn’t just about compliance—it’s about financial stewardship.

Based on common scenarios:

- Executive protection details: ≈ $110,000 annual savings

- Residential security upgrades: $21–37K tax advantage

- Secure travel / aviation protection: ≈ $18,000 retained

Total potential impact: 30–45% combined savings when compared to non-compliant protective programs.

For boards and CFOs, that’s a strategic win.

Strategos International’s Four-Phase Assessment Framework

1. Data Collection

A comprehensive intelligence-driven review, including:

- OSINT and threat analysis

- Executive and stakeholder interviews

- Residential and site assessments

- Travel exposure evaluation

- Governance and policy review (10-K, proxy statements, etc.)

2. Analysis & Research

All data is converted into a structured Executive Risk Framework, integrating legal, business, reputational, and family-related considerations.

3. Report Development

Strategos delivers:

- Tailored recommendations

- Compliance mapping (IRS §132, DHS/FEMA, ASIS CPP, NFPA standards, etc.)

- A phased implementation plan

4. Independent Security Study (ISS)

A third-party expert validates all findings and provides formal documentation that has repeatedly held up under IRS audit scrutiny.

This final step is essential for audit defense, governance assurance, and long-term compliance.

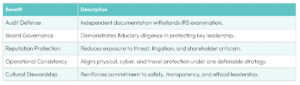

Beyond Tax Benefits: Organizational Value

Implementing a §132-aligned strategy strengthens the enterprise in several ways:

- Audit defense: Defensible third-party documentation

- Board governance: Demonstrates fiduciary responsibility

- Reputation protection: Reduces exposure to threats and criticism

- Operational consistency: Aligns cyber, travel, physical, and residential protection

- Culture & stewardship: Reinforces commitment to people and leadership safety

Timeline and Deliverables

A typical engagement lasts approximately 12 weeks, culminating in:

- Draft and final assessment reports

- Independent Security Study validation

- A detailed implementation roadmap

Key Takeaways for Organizations

- Security costs can legally become tax-advantaged expenses.

- Executives avoid 35–40% personal tax impact.

- Companies can reduce overall protection costs by up to 45%.

- Independent validation creates audit-proof confidence.

- Strategos delivers a complete, integrated framework.

In an environment where threat levels are rising and scrutiny on corporate governance continues to intensify, Section 132 provides a strategic, compliant, and financially sound path forward.

Protect Your People—Before the Threat Becomes Reality

Strategos International stands ready to help leaders navigate this process with the highest levels of intelligence, discretion, and trust.